CARM Client Portal (click here to access the CARM Portal)

CARM (CBSA Assessment and Revenue Management)

Before your shipments can re-enter Canada, they must be in compliance with the CBSA. The CBSA requires registration with the digital initiative called CARM. In addition, you are required to file a document called a Power of Attorney (POA) that allows Chit Chats and our customs broker to clear returns on your behalf immediately after confirming CARM registration.

CARM Key Terms

- A Business Number for Importing is required for registering with CARM. This consists of:

The Business Number (BN), a unique, nine-digit number which is unique to a business or legal entity.

Program Account: two letters (program identifier) and four digits (reference number) attached to the BN, which is used for specific business activities that must be reported to the CRA

If you have a Business Number with an Importer Program Number (RM), proceed directly to creating a user account here

If you have a Business Number but do not have an Importer Program Number (RM), follow the instructions here

If you do not have a Business Number, follow the instructions here to register for one.

Note: If you are a sole proprietorship or partnership, and you do not need to register for other CRA Program Accounts, you can register for a BN using the CARM Client Portal.

Statement of Account (SOA)

- A Statement of Account (SOA) is a financial record that summarizes all transactions between a customer and a supplier within a defined period.

- Depending on your situation, you may need to answer one or more questions about your account on the CARM platform:

- The date (MM/YYYY) and the balance of one Statement of Account (SOA) within the last six years of the current date

- The date (MM/YYYY) and the exact amount of one payment that has been applied to your account within the last six years of the current date

- The transaction number and the total amount of duties and taxes for one import accounting transaction accepted by the CBSA within the last six years of the current date

- Chit Chats may be able get this information from our broker if you do not have them already. If you have had other activity with another broker, you will have to reach out to them directly for this information.

Release Prior to Payment (RPP)

- RPP is a special program that and permits you to obtain the release of goods from CBSA before paying duties and taxes, thus defer accounting for the goods and the payment of duties and taxes

Delegation of Authority (DOA)

- Delegation of Authority is for our customs broker, this must be accepted by you in your CARM Portal to complete the enrolment.

How do I register for CARM?

To create a user account in the CARM Client Portal, please review the onboarding document provided by CBSA here.

For specific details on creating login credentials in the CARM Portal, follow the steps outlined in this video.

When setting up your portal for the first time, choose the 'Register my business' option and select the Program Type as "Importer" and the Importer Type as "Commercial."

For instructions on how to link your business account to the CARM Client Portal, click here. You can equally access the CARM Client Portal link via your Return Settings.

You must register with CARM and immediately submit a POA for approval; it will be denied otherwise.

You must register for the RM program number in order for our broker to approve your POA.

RRP Sub-Program

If you have an incomplete CARM registration or registered before the RPP sub-program was available, you would have to register for the RRP sub-program.

Please follow the steps outlined in the attached PDF to enroll in the RPP sub-program. Kindly note that until this enrollment is complete, any U.S. and USPS international returns will remain on hold.

Once your enrollment is successful, the button next to "Release Prior to Payment" in your CARM portal will appear greyed out and unavailable for selection. In addition, you will see "Release Prior to Payment (RPP)" in the Active section of the “Sub-Programs” tab.

What should I do after registering with CARM?

Once you have created your user account in the CARM Client Portal, head back to your Returns Settings and confirm that you have registered with CARM.

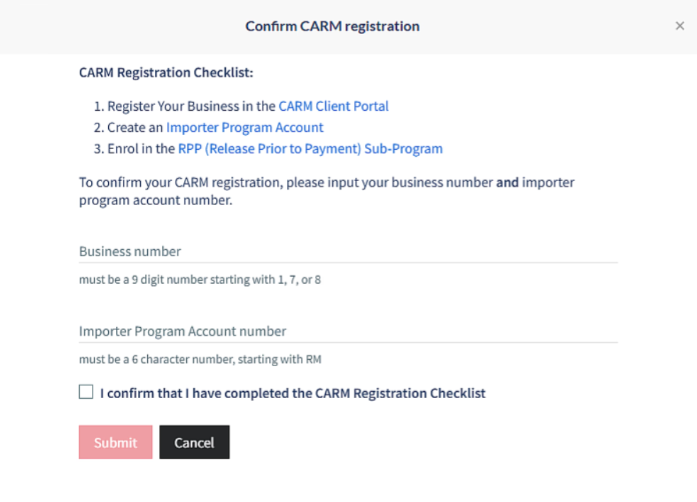

When you click on the CARM section within your Return Settings, you’ll be directed to a checklist outlining the required steps, as mentioned earlier in this article. To confirm your CARM registration, you must enter your Business Number and RM program number, which will be securely transmitted to our broker. Once this step is complete, it’s important to immediately begin the POA registration process to avoid any delays.

Follow the instructions here.

FAQ

Why do I need a GCkey or access to my financial institution?

As CARM is managed by the Canadian Border Services Agency and users need a CRA Business number, logging in using their GCKey or through a financial institution connected to their CRA Account is necessary. This login method is the same as what is used for accessing the CRA website to retrieve tax information, federal benefits, credits, and more.

What can I do if I do not own or run a business?

If you do not currently own or help run a business, you still have the option to register with the CRA for their Import/Export program, which is needed to bring your returns back to Canada. For more information on what's required, please contact the CRA directly.

What if I choose not to register a business number?

If you choose not to register for a business number, Chit Chats will be unable to manage your U.S. returns. You can add your own U.S. return address to manage your return shipments or you can opt to dispose of your returns instead.

Are there any other required tasks after submitting the information relating to CARM?

It is important that once you have registered on the CARM client portal that you log in on a regular basis. For security purposes, accounts created in the CARM Client Portal are deactivated after 180 days of inactivity.

What information can Chit Chats provide?

Chit Chats can only provide information received from our broker. For example, a transaction number may be required for CARM registration, which is provided on the Statement of Account by our broker. For further inquiries, you may need to consult CBSA directly.